Brenda Kinnear

Brenda Kinnear

Buy land, they’re not making it anymore.

- Mark Twain

Underneath all is the dirt. An idea that seems to have passed over the heads of most pundits opining on the real estate market in Metro Vancouver today. There is a history here of wild swings, adjustments and upward trajectory. This is probably one of the best times in recent history to buy a property in some of the nicest areas of Vancouver and surrounding communities.

Bloomberg reports that Toronto and Montreal home sales rose in April while those in Metro Vancouver declined. Most of Canada is stabilizing and absorbing the effects of the mortgage stress test.

A devastating article in the Vancouver Sun highlighted the damage that has been caused by provincial real estate taxes as well as the federal mortgage stress test. Paul Sullivan senior partner at Burgess, Cawley, Sullivan and Associates, a commercial real estate and property tax appraisal firm estimated a loss of $89.2 billion in home equity across the region since median house prices declined between April 2018 and April 2019.

One of the difficulties in this Wild West real estate cycle is that there are casualties. Buyers who are temporarily underwater on a mortgage taken out when the property was assessed at 10% more; older residents heading for retirement who were counting on their increased home equity to finance the cost of care; parents who invested in their children’s education or house purchase. It’s like throwing a rock into a pond. There is an ever widening ripple effect.

The Globe and Mail published an interesting wide-ranging article on the pain being felt in the Vancouver real estate market and how many sellers are losing millions in equity and potential buyers are sitting on the sidelines. Schadenfreude on every side.

It discusses the quandary of condo developers who are wondering what to do with planned projects. They are paying huge realtor bonuses on sales in completed projects. China is now jailing for life its citizens who take money from the country illegally. An anomaly to Metro Vancouver is the low salary range for professionals and IT employees. There is not the deep pool of well paid working residents who will be able to push prices back up again as overseas investors have done. One realtor interviewed pointed out that the changes vary according to neighbourhood. Right now successful millennials are lining up at open houses on the diverse Eastside and buying up any halfway decent house that comes for sale. Plus ça change, plus c'est la même chose.

"Vancouver Spring" by Miguel Garcia

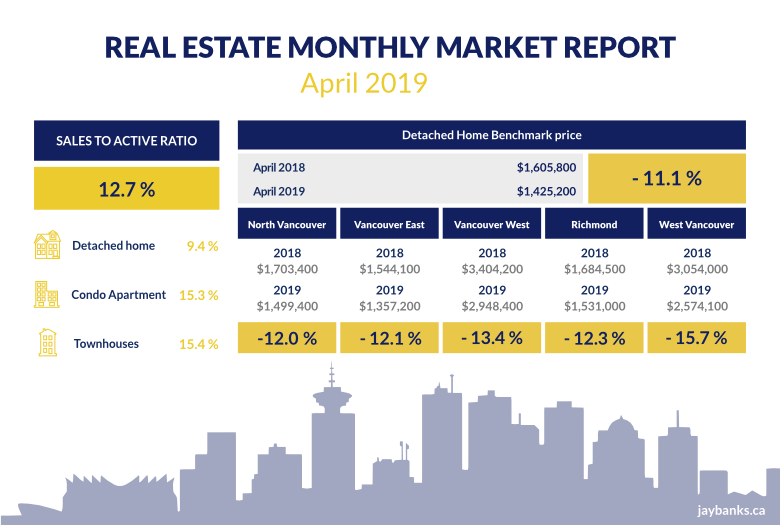

Detached homes sales have declined 27.4% compared to April 2018. The detached benchmark price across the region is $1,425,200, a 11.1% decrease from April 2018.

Townhomes are desirable to downsizing buyers but the drop in the numbers of sales of detached homes has put many buyers plans on hold. Attached sales numbers are down 22.8% from April 2018, The benchmark price across the region is $783,300, a 7.5% price decrease compared to April 2018.

Condominiums which were the choice of first time buyers in 2017 have been heavily impacted by the mortgage stress test and rising interest rates. Apartment sales numbers are down 32.3% from April 2018. The regional benchmark price is $656,900, a 6.9% decrease compared to April 2018.

"There are more homes for sale in our market today than we’ve seen since October 2014. This trend is more about reduced demand than increased supply." as stated by Ashley Smith President, Real Estate Board of Greater Vancouver. " The number of new listings coming on the market each month are consistent with our long-term averages. It’s the reduced sales activity that’s allowing listings to accumulate."

For all property types the sales to active listing ratio for April 2019 is 12.7%.

In April 2019 the benchmark price for a detached in North Vancouver was $1,499,400 down 12.0% in one year, up 51.2 % in 5 years and up 93.5% in 10 years.

In Richmond the detached benchmark price was $1,531,000 down 12.3% in one year, up 51.3% in 5 years and up 118.6% in 10 years.

In Vancouver East the detached benchmark price was $1,357,200 down 12.1% in one year, up 50.8% in 5 years and up 126.1% in 10 years.

In Vancouver West the detached benchmark price was $2,948,400 down 13.4% in one year, up 33.8% in 5 years and up 118.4% in 10 years.

In West Vancouver the detached benchmark price was $2,574,100 down 15.7% in one year, up 30.2% in 5 years and up 104.2% in 10 years.

Each year affordability declined for local buyers. First time buyers are particularly hard hit by mortgage stress tests, high prices and lack of affordable inventory.

In April 2019 the benchmark price for a condo apartment in North Vancouver was $567,500 down 8.6% in one year, up 56.3% in 5 years and up 80.4% in 10 years.

In Richmond the condo benchmark price was $654,900 down 6.5% in one year, up 75.5% in 5 years and 105.9% in 10 years.

In Vancouver East the condo benchmark price was $547,900 down 4.7% in one year, up 71.6% in 5 years and up 108.8% in 10 years.

In Vancouver West the condo benchmark price was $764,600 down 9.2% in one year, up 56.3% in 5 years and up 88.8% in 10 years.

In West Vancouver the condo benchmark price was $1,128,500 down 12.9% in one year, up 61.2% in 5 years and up 83.0% in 10 years.

More anon.