Brenda Kinnear

Brenda Kinnear

The excessive increase of anything causes a reaction in the opposite direction.

- Plato

In 375 BCE ancient Greek philosopher Plato must have been foreseeing the 2019 real estate market in Metro Vancouver. We are indeed seeing the other side of the euphoric house price increases of 2014-2018 before world events and government taxes and regulations combined to end the party. Too bad for anyone who was thinking to downsize with retirement equity.

March was on the cusp of change, April is confirming new numbers of sales and reduced prices. Sales numbers have hit a three decade low.

The Vancouver Sun reports that house prices are falling in desirable cities around the world. The Economist magazine described tumbling prices in Hong Kong, London, New York, Sydney and Vancouver as "excess being shed" after years of price gains that "bulged". It said that prices for prime properties in Vancouver have fallen by 12%. Prominent local realtors in high end neighbourhoods say that owners are only selling if they must but that the new lower sale prices become the benchmark in the marketplace. In Hong Kong prices are down more than 9%, in Sydney prices have dropped 16% since 2017 while Manhattan prices are down 4.3%. According to online listing firm StreetEasy 60% of homes in the US listed over $1 million in 2018 failed to sell. These markets are impacted by similar trends in international wealth and mobility. The projection for the next 5 years is that there will be fewer new millionaires to invest in property, The restrictions on currency movement by Mainland Chinese investors has seriously impacted the prestigious international real estate markets.

There are several points of view on how heavily the provincial wealth taxes are impacting investment here. On a recent panel a prominent local real estate executive who had worked in Shanghai commented on how government intervention is tarnishing the reputation of the province with international investors. Other panelists from the US and Hong Kong stated that Vancouver’s reputation for value and stability and Canada’s openness to immigration would continue to drive investment into this market. They commented that other jurisdictions like Singapore and Hong Kong have foreign buyer taxes and their markets have not collapsed. The general consensus of the panel was that the Chinese restriction of currency leaving the country did have an impact but that there was lots of Chinese capital sitting in Hong Kong, Malaysia, London and Singapore that could find its way to markets in Canada.

"Old and New" by Nico Zobrist on Unsplash

Recently the Bentall Centre, a marquee commercial development in downtown Vancouver was sold to an American consortium including the Blackstone Group by Anbang Insurance of Beijing. In the days of the Chinese government encouraging overseas investments Anbang purchased the Waldorf-Astoria Hotel in New York, the largest chain of nursing homes in BC plus the Bentall Centre. The new purchase price was undisclosed but the Bentall Centre sold to Anbang in 2016 for $1.06 billion.

It appears that Chinese investors are turning from Vancouver to Toronto for commercial real estate investments. According to Bloomberg investment has collapsed from a flood of regulations here and investment capital has moved on to Ontario. A senior commercial realtor stated that BC changes policy on a whim and that investors who typically look for stability are not finding it locally. Investor groups plan to move their Asian clients to Toronto which has a booming tech and financial services market enhanced by a flood of immigrants and millennials. Vancouver is considered to be more of a retirement market.

More anon.

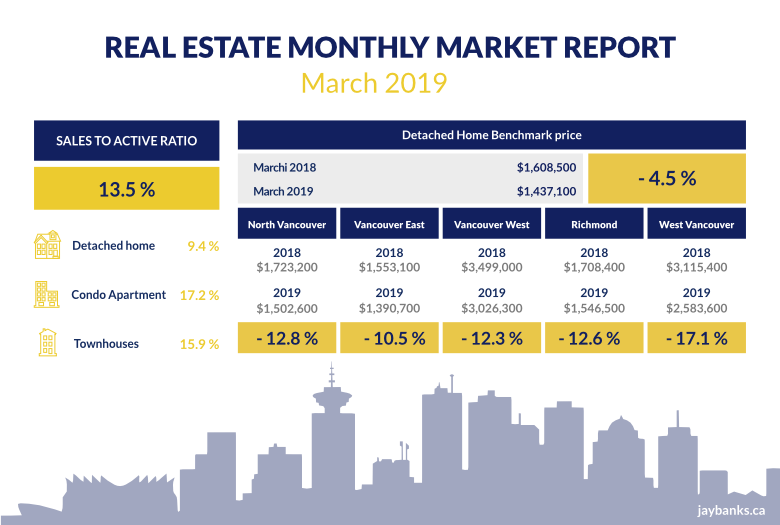

Detached homes sales have declined 26.7% compared to March 2018. The detached benchmark price across the region is $1,437,100, a 10.5% decrease from March 2018.

Townhomes are desirable to downsizing buyers but the drop in the numbers of sales of detached homes has put many buyers plans on hold. Attached sales numbers are down 27.1% from March 2018, The benchmark price across the region is $783,600, a 6.0% price decrease compared to March 2018.

Condominiums which were the choice of first time buyers in 2017 have been heavily impacted by the mortgage stress test and rising interest rates. Apartment sales numbers are down 35.3% from March 2018. The regional benchmark price is $656,900, a 5.9% decrease compared to March 2018.

"Housing demand today isn’t aligning with our growing economy and low unemployment rates. The market trends we’re seeing are largely policy induced." as stated by Ashley Smith President, Real Estate Board of Greater Vancouver. "For three years, governments at all levels have imposed new taxes and borrowing requirements on the housing market."

For all property types the sales to active listing ratio for March 2019 is 13.5%.

In March 2019 the benchmark price for a detached in North Vancouver was $1,502,600 down 12.8% in one year, up 54.1 % in 5 years and up 96.5% in 10 years.

In Richmond the detached benchmark price was $1,546,500 down 12.6% in one year, up 54.4% in 5 years and up 123.6% in 10 years.

In Vancouver East the detached benchmark price was $1,390,700 down 10.5% in one year, up 56.9% in 5 years and up 134.5% in 10 years.

In Vancouver West the detached benchmark price was $3,026,300 down 12.3% in one year, up 38.9% in 5 years and up 128.1% in 10 years.

In West Vancouver the detached benchmark price was $2,583,600 down 17.1% in one year, up 32.0% in 5 years and up 107.2% in 10 years.

Each year affordability declined for local buyers. First time buyers are particularly hard hit by mortgage stress tests, high prices and lack of affordable inventory.

In March 2019 the benchmark price for a condo apartment in North Vancouver was $567,000 down 7.0% in one year, up 57.3% in 5 years and up 83.2% in 10 years.

In Richmond the condo benchmark price was $653,400 down 3.3% in one year, up 75.2% in 5 years and 108.6% in 10 years.

In Vancouver East the condo benchmark price was $547,700 down 5.2% in one year, up 71.9% in 5 years and up 111.9% in 10 years.

In Vancouver West the condo benchmark price was $769,200 down 8.9% in one year, up 56.5% in 5 years and up 94.2% in 10 years.

In West Vancouver the condo benchmark price was $1,116,200 down 12.7% in one year, up 57.0% in 5 years and up 85.6% in 10 years.

More anon.