Brenda Kinnear

Brenda Kinnear

"The pessimist complains about the wind.

The optimist expects it to change.

The leader adjusts the sails."

- John Maxwell

We are all adjusting our sails in this volatile real estate market. Even adjusting the sails can’t help when the wind dies and you are temporarily becalmed.

The Metro Vancouver real estate market number of sales declined by 36% year over year; the Fraser Valley sales declined by 39% and the Victoria market declined by 17%. The prices did not drop accordingly. There have been adjustments to some sale prices and we are not seeing the rising prices or multiple offers of last year or even this Spring. Many sellers made future plans based on an historic sale price of their property. When that historic price could not be achieved this year some have reduced the listing price, other homes have come off the market.

The slowdown in detached home sales has cascaded down into attached and condominium sales. Townhomes that would have been purchased by downsizing sellers of detached homes are not receiving offers. Condominiums in the mid-high price range are affected by this and the lower-mid priced condos don’t match what first time buyers can purchase under the Mortgage Stress Test. Last year they could buy for $600,000. Under the stress test they qualify for 20% less financing so can only purchase for $480,000 so can’t buy a home to accommodate a family.

Given that over this same time frame the Toronto market sales number has risen by 8% the partial answer must be affordability. Their average sale prices for August 2018 are lower priced than Metro Vancouver. In Toronto a detached home is $1,244,275; a semi-detached (1/2 duplex in Vancouver) is $891,208; a townhome is $683,160; a condo is $585,355.

Vancouver Lookout View by GoToVan

Everyone in BC is concerned about affordability and how to provide more housing. There is no common agreement on how it can be achieved. The NDP government’s approach to the real estate market which in the recent past has funded much of the government activity is doctrinaire. The Finance Minister stated that she welcomed Finance Ministry data showing reduced revenue from property transfer taxes and sales declines since April stating that she believes the province has to move away from an economy based on real estate speculation. The Leader of the Opposition replied that he sees jobs losses and a sputtering economy in the near future. The Finance Minister stated that the government doesn’t control all the factors that relate to housing interest rates and mortgage rules but it does want property prices to moderate and vacancy rates to increase.

Their plan to make this happen is to apply a speculation tax on non-residents and residents who have a second home that they don’t rent out including cottages or condos in the Lower Mainland, the Victoria and Nanaimo areas plus Kelowna. Other areas are temporarily exempt leading to complaints by the mayors across BC that these unfairly applied policies are destroying the economies of their cities. In some the developers are leaving and in others the rise in a rush of buyers from higher priced areas is pushing the local residents out.

Andrew Weaver the Green Party leader in a coalition with the NDP states that the speculation tax is unfair to BC residents and other Canadians who are being charged a vacancy tax on recreational and secondary residences whether they are being held for speculative purposes or not. Especially since 70% of the people being taxed are BC or Canadian residents. Andrew Wilkinson the Liberal leader agrees that the speculation tax is a tax on retirement homes and family cabins.

According to the BC Government website: In 2018, the tax rate for all properties subject to the tax is 0.5% on the property value. In 2019 and subsequent years, the tax rates will be as follows: • 2% for foreign investors and satellite families; • 1% for Canadian citizens and permanent residents who do not live in British Columbia; and • 0.5% for British Columbians who are Canadian citizens or permanent residents (and not members of a satellite family).

In the recent past most higher end detached homes have been purchased by Chinese buyers looking to relocate the family while the husband worked in China or those wishing to purchase a second home for holidays and investment which is empty for most of the year or buying older homes as building lots. Those buyers have disappeared. China has cracked down on citizens moving money out of the country. Right now the renminbi, China’s currency is being devalued as a result of the trade war with the US. This makes Chinese exports more attractive but the Chinese government is worried that there will be a run on the currency as people move their money to a safer country so they are enforcing the rules against investing overseas. The BC government has instituted higher taxes on offshore buyers/investors or satellite families by increasing the Foreign Buyer property transfer tax to 20% of the purchase price. According to the firm Rosen Kirshen the 2018 Provincial Budget introduced an increase in the school tax, which is set to begin in 2019 on properties valued at over $3-million. There will be an increase of 0.2% on properties valued over $3-million, whereas there will be a 0.4% increase on properties worth over $4-million. This increase is based on the value of these properties, rather than gains created by sale. To enforce these taxes, the B.C. Government will be introducing a publicly accessible registry listing who owns real estate in the province. The registry is meant to boost transparency and minimize opportunities for tax evasion and money laundering. It is expected to go live in the fall.

Money laundering is a world wide problem. In the UK they are cracking down on illegal funds from Russia and Africa. In Vancouver the casino model worked for years and funneled laundered cash from Asia into real estate investments in Metro Vancouver.

There is now vigorous oversight in both the UK and Canada with changes to banking regulations so that the source of funds has to be proved by the depositor. This is a positive move by the formerly lax and trusting federal government and has mainly moved illegal money out of the real estate market.

Townhomes are desirable to downsizing buyers but the drop in the numbers of sales of detached homes has put many buyers plans on hold. Sales numbers are down 36,3% from August 2017, The benchmark price across the region is $846,100, a 7.9% price increase compared to August 2017.

Condominiums which were the choice of first time buyers last year have been heavily impacted by the mortgage stress test and the 10.3% price increase from August 2017. The regional benchmark price is $695,500.

"Home buyers have been less active in recent months and we’re beginning to see prices edge down for all housing types as a result," as stated by Phil Moore President Real Estate Board of Greater Vancouver. "Buyers today have more listings to choose from and face less competition than we’ve seen in our market in recent years."

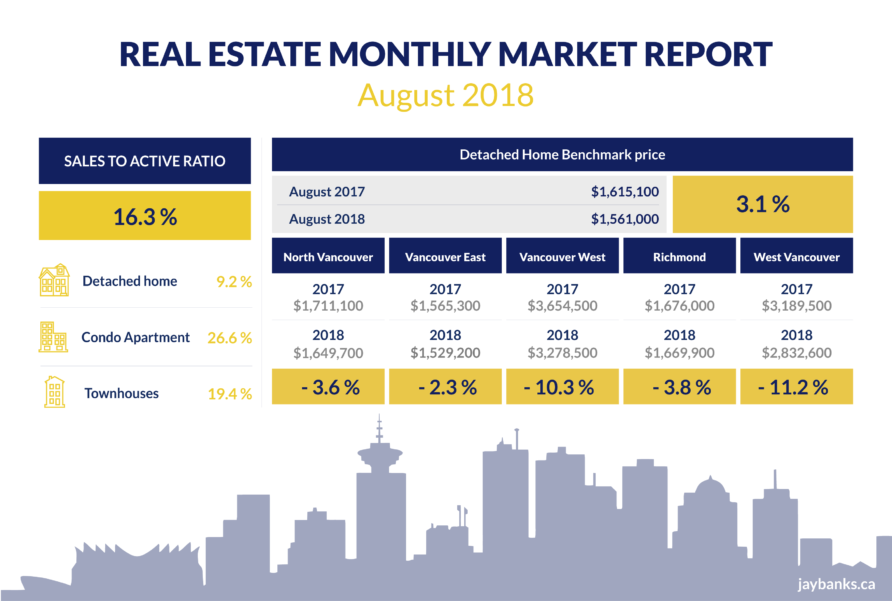

The sales to active listing ratio for August 2018 is 16.3%. By property type, the ratio is 9.2% for detached homes, 19.4% for townhouses, and 26.6% for condominiums.

In August 2018 the benchmark price for a detached home across the region was $1,561,000. A 3.1% decrease from August 2017.

In August 2018 the benchmark price for a detached in North Vancouver was $1,649,700 down 3.6% in one year, up 71.3% in 5 years and up 88.3% in 10 years.

In Richmond the detached benchmark price was $1,669,900 down 3.8% in one year, up 69.5% in 5 years and up 115.5% in 10 years.

In Vancouver East the detached benchmark price was $1,529,200 down 2.3% in one year, up 80.2% in 5 years and up 133.7% in 10 years.

In Vancouver West the detached benchmark price was $3,278,500 down 10.3% in one year, up 57.5% in 5 years and up 114.5% in 10 years.

In West Vancouver the detached benchmark price was $2,832,600 down 11.2% in one year, up 51.5% in 5 years and up 82.8% in 10 years.

Each year affordability declined for local buyers. First time buyers are particularly hard hit by mortgage stress tests, high prices and lack of inventory.

In August 2018 the benchmark price for an apartment property across the region was $695,500. This was a 10.3% increase from August 2017.

In August 2018 the benchmark price for a condo apartment in North Vancouver was $596,400 up 6.7% in one year, up 66.6% in 5 years and up 67.7% in 10 years.

In Richmond the condo benchmark price was $685,500 up 12.8% in one year, up 87.5% in 5 years and 94.8% in 10 years.

In Vancouver East the condo benchmark price was $569,300 up 7.5% in one year, up 87.3% in 5 years and up 94.6% in 10 years.

In Vancouver West the condo benchmark price was $825,000 up 4.8% in one year, up 75.7% in 5 years and up 85.1% in 10 years.

In West Vancouver the condo benchmark price was $1,190,200 up 5.5% in one year, up 63.9% in 5 years and up 67.1% in 10 years.

More anon.

DT00SS