Brenda Kinnear

Brenda Kinnear

"The Moving Finger writes; and, having writ,

Moves on: nor all thy Piety nor Wit

Shall lure it back to cancel half a Line,

Nor all thy Tears wash out a Word of it." Omar Khayyam

Hindsight is always 20/20 and second guessing the real estate market is a fool’s game but that doesn’t stop the big sigh of regret when the rules and outcomes change.

In May according to the Bloomberg Nanos Canadian Confidence Index Canadian consumers have been affected by the global financial turmoil in general and concerns about the Canadian economy including the pipeline standoff between BC and Alberta and Ottawa, the stalling NAFTA negotiations and political turmoil in and outside of Canada. The uncertainty about the housing market and rising interest rates have played into these economic concerns.

The Vancouver Sun has discussed several points of view on what is impacting the housing market in BC, particularly in the Metro Vancouver area. In May both the Real Estate Board of Greater Vancouver and the Fraser Valley Real Estate Board saw a 35% reduction in the number of sales compared with May 2017. Cameron Muir chief economist for the BC Real Estate Association attributes it to new mortgage qualification rules, higher interest rates and high housing prices that have reduced the purchasing power of first time buyers. The Foreign Buyer Tax and Provincial Speculation Tax on second homes and City of Vancouver’s Empty Home Tax don’t affect enough properties to change the affordability factor now but they do contribute to an ephemeral change in attitude and confidence in the future.

Royal LePage is predicting a substantial drop in recreational property prices in BC in the most popular areas that are targeted by the Speculation Tax. Although it was supposed to affect out of country, out of province home owners it is a big enough net to catch mainly BC residents. At this time the taxes are popular with unaffected BC residents hoping they will make the market more affordable.

Affordability is one issue, the dearth of any kind of rental housing in the Lower Mainland, particularly in Vancouver is a huge social problem. Former NDP Premier Mike Harcourt contributed his opinion to the discussion adding that he wasn’t running for any office so he could state the obvious solution that would offend many single family home owners. He says that it’s not a crisis, it’s a permanent condition that has to be addressed by increasing the supply of rental and social housing and speeding up approvals for development of such. He would get rid of the single family zoning and fast track approval of row housing and two and three bedroom townhouses with increased density around schools, bus lines and rapid transit stations. He was speaking in Victoria at a forum on urban issues sponsored by the United Nations Association. Vaughn Palmer of the Vancouver Sun reported on the forum.

Vancouver Skyline by domo.k

Harcourt was critical of the Speculation Tax and the School Tax on $3 million + homes. His point was that the taxes should become a surcharge on income taxes so that low income seniors weren’t so hard hit. He warned the NDP about left wing doctrinal beliefs in soaking the rich and setting up class warfare confrontations which he said his government had done with a previous surcharge on the school tax and had to backtrack when they realized how unfair and divisive it was. However, the current NDP government thinks taxing the "rich folk" is politically advantageous to them at this time. Most would agree but they are not identifying the real "Rich", the foreign buyers who own homes, establish their families here and pay no provincial income tax.

Interestingly there is a sense that the Vision Vancouver majority on City Council is moving toward a huge change in the city plan and an enormous investment in affordable rental and social housing by contributing city owned lands to developers to build affordable projects. The ideas have been out there since 2017 but it is now the last gasp of the Mayor’s and Council’s terms and they want this legacy project approved.

According to Frances Bula of the Globe and Mail:

Vancouver is set to adopt a dramatically revised housing plan that will change the make-up of single-family neighbourhoods, promote dense new clusters of residences in designated areas and create a $2-billion affordable-housing fund.

The new initiative will allow duplexes automatically as a choice in most of the city’s single-family neighbourhoods, as well as aiming to ensure that two-thirds of a hoped-for 72,000 homes built in the next 10 years are rentals.

All of that will require dedicating about $2.5-billion of city land to housing and grappling with residents unhappy about such significant change, city housing officials admit.

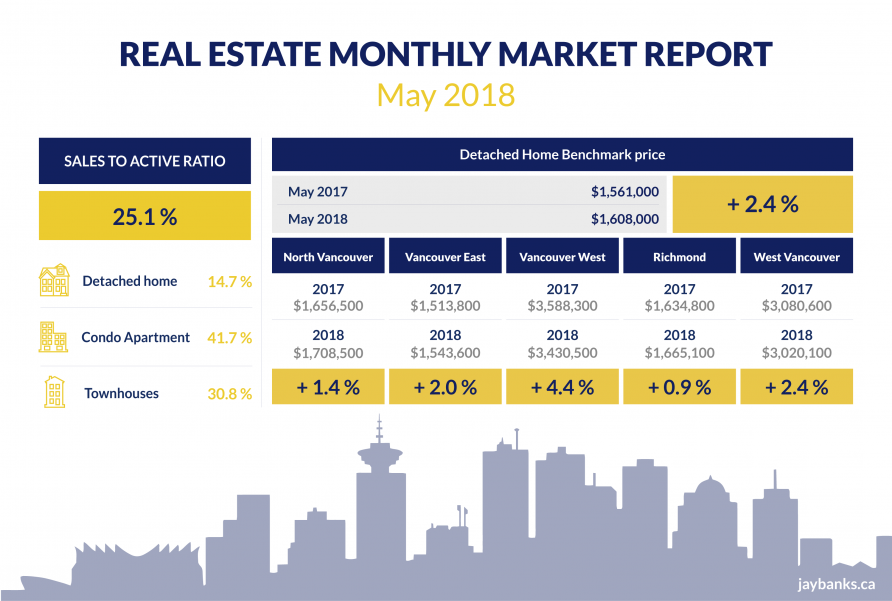

The detached home market has been heavily hit by fewer qualified buyers. The new provincial taxes are impacting the upper price ranges particularly in the high end market in Vancouver Westside, Richmond and West Vancouver. The builders are concerned that they won’t be able to sell a new home at $3 million+ so they aren’t willing to pay as much for a lot to build it on.

Townhomes are in demand but the prices have risen so high that that they are unaffordable to most buyers. Sales numbers are down 39,8% from May 2017, The benchmark price across the region is $859,500, a 16% price increase compared to May 2017.

Condominiums which were the darling of first time buyers last year have been impacted by the new mortgage rules and the 20.2% price increase from May 2017.

"With fewer homes selling today compared to recent years, the number of homes available for sale is rising," as stated by Phil Moore President Real Estate Board of Greater Vancouver. "The selection of homes for sale in Metro Vancouver has risen to the highest levels we’ve seen in the last two years, yet supply is still below our long-term historical average."

Each year affordability declined for local buyers. First time buyers are particularly hard hit by mortgage stress tests, high prices and lack of inventory.

In May 2018 the benchmark price for an apartment property across the region was $701,700. This was a 20.2% increase from May 2017.

In May 2018 the benchmark price for a condo apartment in North Vancouver was $603,600 up 18.6% in one year, up 69.3% in 5 years and up 68.8% in 10 years.

In Richmond the condo benchmark price was $670,700 up 21.4% in one year, up 89.6% in 5 years and 91.1% in 10 years.

In Vancouver East the condo benchmark price was $575,800 up 15.9% in one year, up 86.6% in 5 years and up 93.2% in 10 years.

In Vancouver West the condo benchmark price was $845,400 up 13.3% in one year, up 80.3% in 5 years and up 82.4% in 10 years.

In West Vancouver the condo benchmark price was $1,280,600 up 15.2% in one year, up 76.6% in 5 years and up 78.9% in 10 years.

More anon.

DT00KS