Brenda Kinnear

Brenda Kinnear

When I was a newbie realtor caught in the middle of a major market correction I worked with a client who insisted on listing their property much higher than the current market would bear. An old time realtor in my office said "I always tell them if they want to study ancient history they should go to university".

Across the country the Spring market has not taken hold. The Canadian Real Estate Association blames most of the slowdown on the mortgage stress test that was instituted by the federal government in January 2018.

Even those with 20% down and those renewing their existing mortgage are having to qualify for a rate 2 points higher than the mortgage rate being offered to them. The collateral damage has been heaviest in smaller markets where people don’t have deep pockets.

The new provincial regulations have raised taxes on second homes and investment real estate left empty in the middle of a housing crisis. Most of them are owned by BC residents although the original intention was to tax non-BC taxpayers. The rate is higher for out of province property owners.

It’s easy to be wise after the fact and right now there are more listings coming on the market but fewer sales than in the recent past. Many sellers put off making a decision thinking that the market would continue to soar upwards until they were ready to list their home. The detached home market has been affected by the absence of offshore buyers and investors. The Foreign Buyer Tax add-on to the provincial Property Transfer Tax plus the new government speculation tax has helped to cool that market.

According to Douglas Todd of the Vancouver Sun the top bankers are now saying that foreign wealth is contributing to unaffordability and that we don’t need foreign capital using Canadian real estate as a piggy bank. The National Bank of Canada has stated that "almost $13 billion was spent by Chinese investors in Vancouver" in one recent year alone. This has distorted the affordability factor for all local buyers in Vancouver.

The condominium market has been impacted by local baby boomers looking to sell their homes and gardens and move to easier condo living. They hope to have money to enjoy their retirement and help their kids. Not so easy to do if your main asset is difficult to sell for the higher price you were expecting.

The government is now realising that it gave investors a free pass on buying into pre-sale condominium projects and selling the contract before completion when the Property Transfer Tax was payable. The new rules require the developer to provide details of purchase contracts and assignments. This fear of legal liability has had most developers refusing to authorize assignments going forward. There were huge windfall profits for the first buyers in who had no intention of closing on the unit but were selling it and not declaring the tax liability. It’s clear that there were preferred realtors with clients who made multiple purchases which made life easier for the developer who got his money sooner plus a rake-off on the resale of the contract.

The big issue is affordability and availability of housing, for either rental or purchase. This is a problem throughout Metro Vancouver. All the new rules are slowing down the market and reducing Provincial income but still not making it possible for people to continue to live here. The City of Vancouver has designated City owned property for redevelopment for affordable rental housing stock. The problem is that there are so many more families that need accommodation than what can possibly be built for them. Most Vancouverites favour the Empty Homes Tax although it appears most people are paying it rather than renting out their property. It’s a windfall for city revenues.

In a classic Catch-22 situation the City of Vancouver is working to attract big tech companies with their myriad of employees for the tax base. Well-paid tech workers displace lower income existing tenants as the rents rise in the few available housing units. San Francisco is a case in point. The Silicon Valley workers that go by company bus into the city daily are paying $3500 per month for a one bedroom apartment according to people we know.

A big splash was made by Amazon taking on the Old Post Office by adding towers and 3000 employees in addition to the 2000 employees already here. The Prime Minister came out to make the announcement but did not address housing or immigration issues.

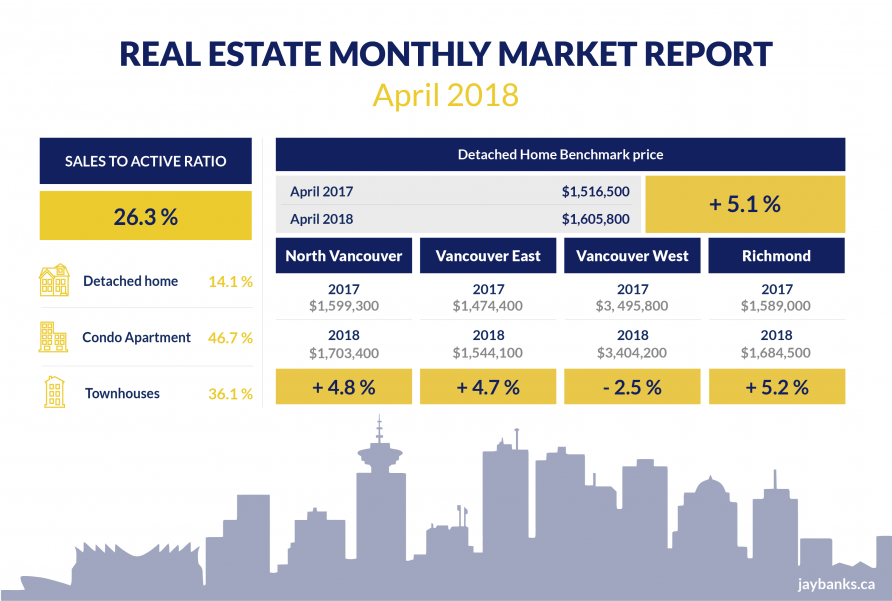

The stats are a bit misleading because the sales of detached properties in April are much lower than in March. In the high end detached market in Vancouver Westside, Richmond and West Vancouver it is the lack of Chinese buyers that is making a difference, combined with high prices and new government taxes.

"Market conditions are changing. Home sales declined in our region last month to a 17-year April low and home sellers have become more active than we’ve seen in the past three years." as stated by Phil Moore President Real Estate Board of Greater Vancouver. "The mortgage requirements that the federal government implemented this year have, among other factors, diminished home buyers’ purchasing power and they’re being felt on the buyer side today."

Each year affordability declined for local buyers. First time buyers are particularly hard hit by mortgage stress tests, high prices and lack of inventory.

In April 2018 the benchmark price for an apartment property across the region was $701,000. This was a 23.7% increase from April 2017.

In April 2018 the benchmark price for a condo apartment in North Vancouver was $611,900 up 23.1% in one year, up 73.2% in 5 years and up 72.5% in 10 years.

In Richmond the benchmark price was $684,100 up 28% in one year, up 92% in 5 years and 96% in 10 years.

In Vancouver East the benchmark price was $574,700 up 19.7% in one year, up 88.4% in 5 years and up 94.1% in 10 years.

In Vancouver West the benchmark price was $841,700 up 16% in one year, up 77.6% in 5 years and up 80.1% in 10 years.

In West Vancouver the benchmark price was $1,295,900 up 20.3% in one year, up 76.1% in 5 years and up 89% in 10 years.

More anon.

DT00KS