Brenda Kinnear

Brenda Kinnear

The secret of change is to focus all of your energy, not on fighting the old, but on building the new.

- Socrates

Sales were down in February 2019 over the sales of February 2018 but they were up over late 2018 and January 2019. Although prices are adjusting, particularly in the detached home market, it is important not to confuse lower sales numbers with lower prices. In checking price point changes we use the benchmark price comparison where model homes with standard popular features are measured against homes of that type that have sold that month. When average sale prices are used they are just looking at prices of homes that have sold divided by the number of sales. In this market where fewer high priced homes are selling a lower average price is attained and suddenly the sky is falling. Not a realistic measuring tool. However, some economists are predicting a larger price drop before rebalancing again.

Affordability is the elusive goal of governments around the world and there are many ways to crash the economy in trying to achieve it. The Federal Government in its recent election budget is trying a system called SEMs or shared equity mortgages. These have been tried in Australia, the UK and US. According to the Haider-Moranis Bulletin the SEM will be run by CMHC which is a long way from being ready to implement such a program. In Canada there is an assumption that millennials have an RRSP of more than $35,000 that they can borrow from for a mortgage or they can share their mortgage with CMHC as the lender for up to $40,000 to reduce the monthly payments of the mortgage with the loan for the SEM being paid back at the end of the mortgage or the sale of the property.

There is a discussion on just how soon this election goody can be mobilized. There are lots of offerings in the Budget that are not fully funded in a timely fashion, including the Home Buyers Plan.

Anne McMullin, president and CEO of the Urban Development Institute in BC, is on the frontlines with developers and politicians trying to create more affordable communities for those who live here and for the up to 40,000 newcomers who will arrive in Metro Vancouver this year plus another 140,000 foreign students and temporary workers. As it stands now there is not enough rental housing or affordable homes to buy for the people who live here now. Over the next three years the number of housing starts is predicted to go down by 30 per cent. In her Vancouver Sun article Ms McMullin outlines suggestions to make more housing possible:

- Build more homes of all types by opening up communities to options such as townhomes, row homes, micro-suites, triplexes, mid-rise buildings.

- More purpose built rentals through financial incentives or targeted tax breaks.

- Link transit funding to building apartments and other home choices near transit hubs.

- Government should ensure fair taxation on homes. Piling on development charges creates more expensive housing for buyers or renters.

- Approval process should be faster, particularly in Vancouver where the approval process takes up to 5 years.

More anon.

Reflection of Vancouver by Nikita Ignatev

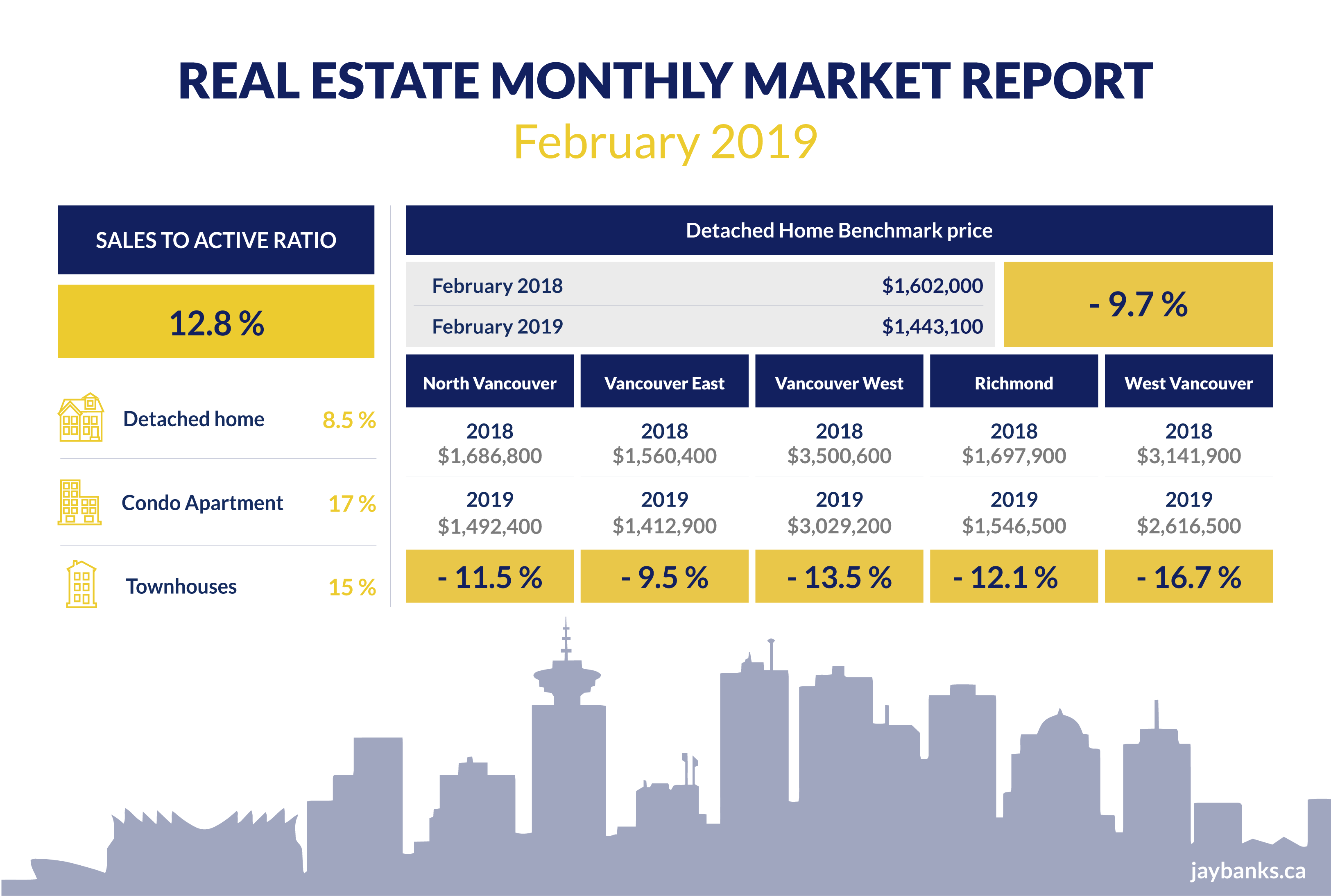

Detached homes sales have declined 27.9% compared to February 2018. The detached benchmark price across the region is $1,443,100, a 9.7% decrease from February 2018. This includes an 7.6% decrease over the past six months.

Townhomes are desirable to downsizing buyers but the drop in the numbers of sales of detached homes has put many buyers plans on hold. Attached sales numbers are down 30.9% from February 2018, The benchmark price across the region is $789,300, a 3.3% price decrease compared to February 2018. This includes a 6.7% decrease over the past six months.

"Homes priced well for today’s market are attracting interest, however, buyers are choosing to take a wait-and-see approach for the time being." as stated by Phil Moore President, Real Estate Board of Greater Vancouver. "Realtors continue to experience more traffic at open houses. We’ll see if this trend leads to increased sales activity during the spring market."

For all property types the sales to active listing ratio for February 2019 is 12.8%.

In February 2019 the benchmark price for a detached in North Vancouver was $1,492,400 down 11.5% in one year, up 55.2% in 5 years and up 93.2% in 10 years.

In Richmond the detached benchmark price was $1,546,500 down 12.1% in one year, up 57.0% in 5 years and up 121.1% in 10 years.

In Vancouver East the detached benchmark price was $1,412,900 down 9.5% in one year, up 61.5% in 5 years and up 137.9% in 10 years.

In Vancouver West the detached benchmark price was $3,029,200 down 13.5% in one year, up 41.1% in 5 years and up 128.2% in 10 years.

In West Vancouver the detached benchmark price was $2,616,500 down 16.7% in one year, up 35.7% in 5 years and up 108.8% in 10 years.

Each year affordability declined for local buyers. First time buyers are particularly hard hit by mortgage stress tests, high prices and lack of affordable inventory.

In February 2019 the benchmark price for a condo apartment in North Vancouver was $561,500 down 4.7% in one year, up 56.7% in 5 years and up 80.1% in 10 years.

In Richmond the condo benchmark price was $660,100 down 2.0% in one year, up 78.3% in 5 years and 109.1% in 10 years.

In Vancouver East the condo benchmark price was $545,200 down 3.6% in one year, up 74.8% in 5 years and up 108.7% in 10 years.

In Vancouver West the condo benchmark price was $784,300 down 6.2% in one year, up 61.0% in 5 years and up 98.2% in 10 years.

In West Vancouver the condo benchmark price was $1,103,800 down 10.8% in one year, up 57.1% in 5 years and up 83.4% in 10 years.