The lazy hazy days of summer have been in the ascendant in 2017. These have been the longest days of no rain and high temperatures since 1958. The fires in the Interior have blanketed the coast periodically with smoke impacting both tourism and breathing. The tourism stats show that there are still people coming to British Columbia but probably re-directing their trip from the national and provincial parks in the Interior to the cities on the coast.

The real estate market always slows down in July and August. This year not so much in the condo sector. According to Jill Oudil President of the Real Estate Board of Greater Vancouver "Housing demand is inconsistent across the region right now. Pockets of the market are still receiving multiple offers and others are not. It depends on price, property type, and location. For example, it’s taking twice as long, on average for a detached home to sell compared to both townhomes and condominiums." The sales to active listings ratio for July 2017 is 32.2 per cent. By property type, the ratio is 16.9 per cent for detached homes, 44.9 per cent for townhouses, and 62 per cent for condominiums.

The impact of the foreign buyer tax and the lower rate of return on detached homes

Last year in July the provincial government announced their foreign buyer tax. It was a mad scramble to close properties before the tax took effect which distorted the market at that moment. However, there was a slowdown in sales for several months afterwards while the market adjusted to the changes. The tax was eventually absorbed by the seller and the buyer of the higher end properties that attracted foreign investment. It did impact the number of detached sales.

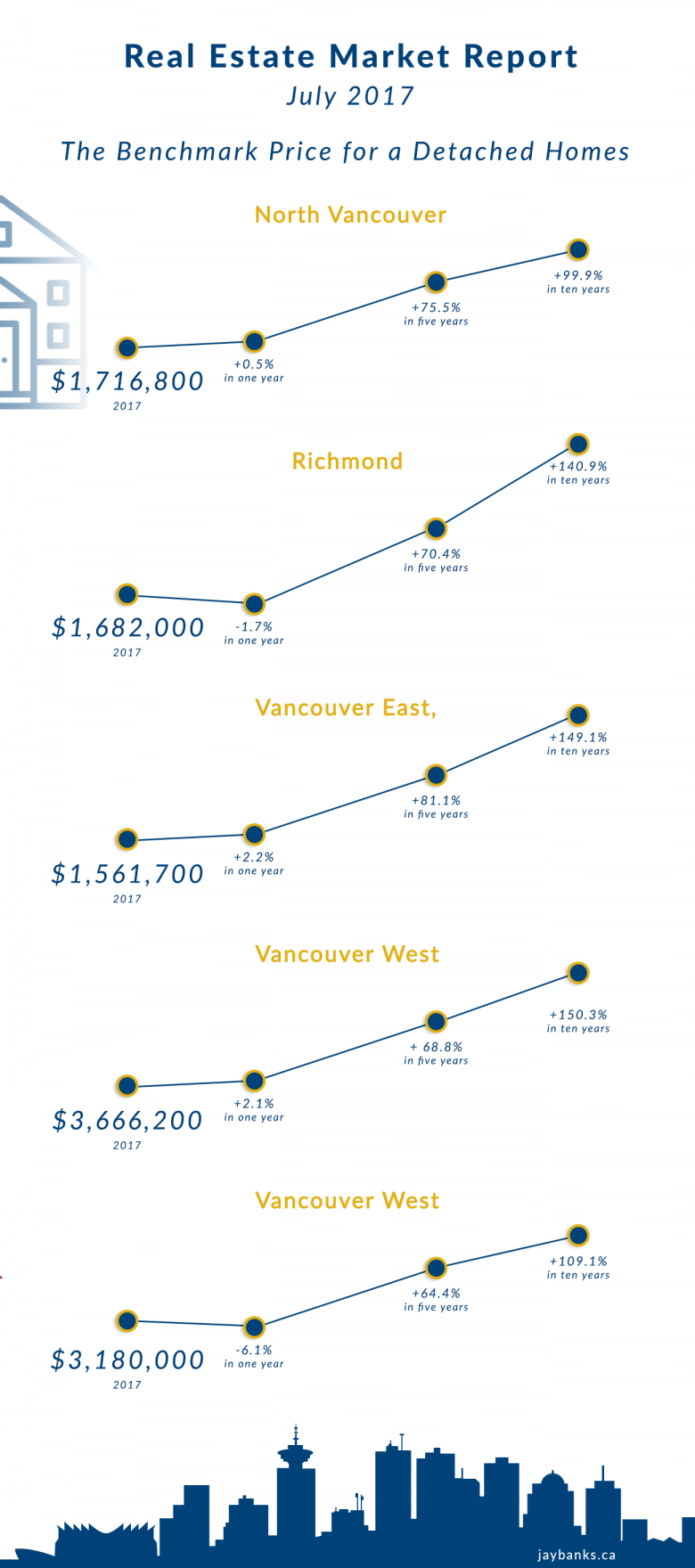

Over several years there was a time of rising prices where investors made huge profits on the buying and selling of detached homes. Part of what slowed the market down in that category is the lower rate of return on detached homes. In July 2017 the benchmark price for a detached home in North Vancouver was $1,716,800 up 0.5 per cent in one year, up 75.5 per cent in 5 years and up 99.9 per cent in 10 years. In Richmond, the benchmark price was $1,682,000 down 1.7 per cent in one year, up 70.4 per cent in 5 years and up 140.9 per cent in 10 years. In Vancouver East, the benchmark price was $1,561,700 up 2.2 per cent in one year, up 81.1 per cent in 5 years and up 149.1 per cent in 10 years. In Vancouver West, the benchmark price was $3,666,200 up 2.1 per cent in one year, up 68.8 per cent in 5 years and up 150.3 per cent in 10 years. In West Vancouver, the benchmark price was $3,180,000 down 6.1 per cent in one year, up 64.4 per cent in 5 years and up 109.1 per cent in 10 years. Each year affordability declined for local buyers.

These rising prices coincided with all levels of government looking away from the illegal activities going on in the market. CRA did not inspect false claims of primary residence on empty houses which resulted in many investors, developers and speculators avoiding the capital gains tax and cheating the Treasury of billions of dollars. Nothing happened until the Globe and Mail wrote an expose of Vancouver real estate practices and the Superintendent of Insurance convened a committee to investigate and report back. There have been many improvements with more on the way. Now that CRA is looking closely at tax avoidance and requiring statutory declarations and proof of residence the desirability of detached homes has somewhat diminished.

The buyers are shifting towards the condo market

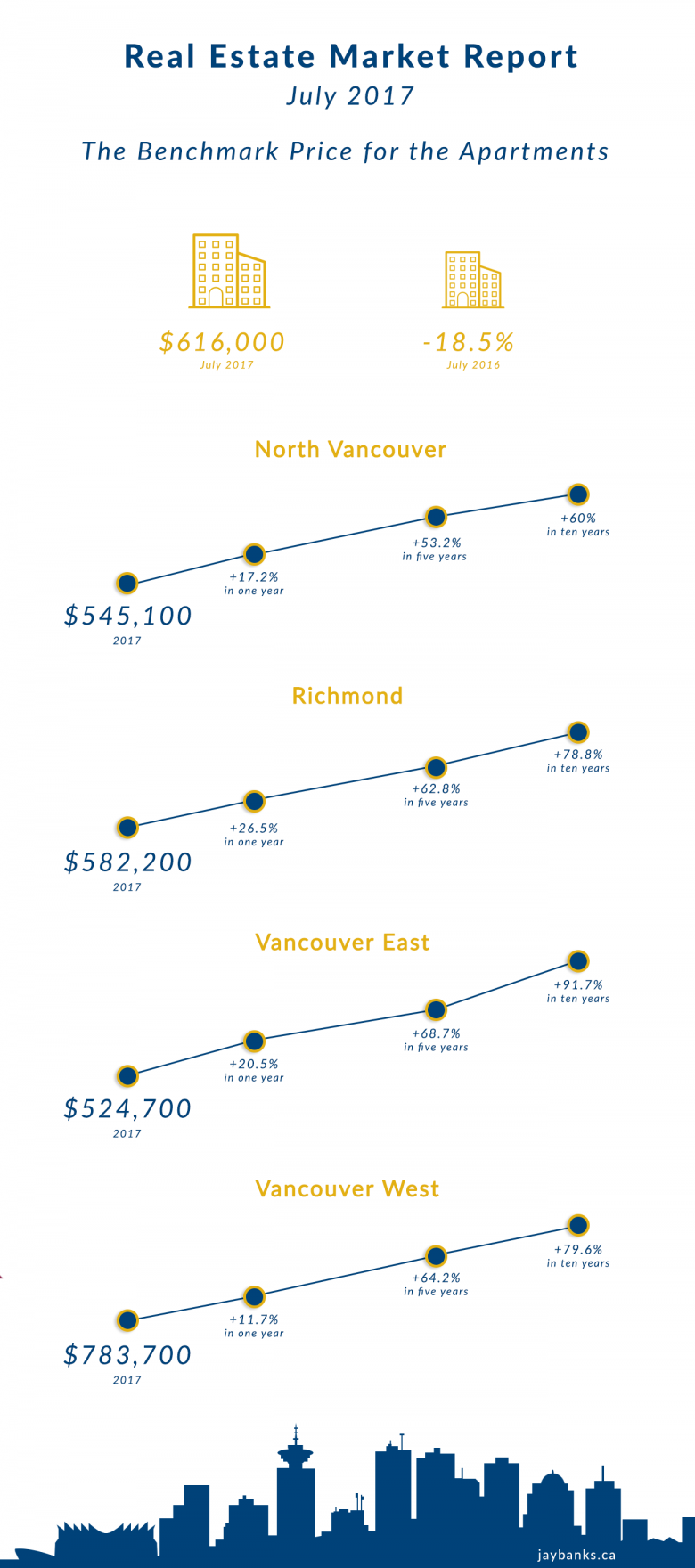

Foreign investment and local buyers have moved into the condo market. Particularly the pre-sale market. There are many complaints that planned developments are being pre-sold offshore so that there are no affordable units left unsold when the project hits the market in Vancouver. Local buyers are closed out. In July 2017 the benchmark price for an apartment property across the region was $616,000. This was an 18.5 per cent increase from July 2016. In July 2017 the benchmark price for a condo apartment in North Vancouver was $545,100 up 17.2 per cent in one year, up 53.2 per cent in 5 years and up 60 per cent in 10 years. In Richmond, the benchmark price was $582,200 up 26.5 per cent in one year, up 62.8 per cent in 5 years and up 78.8 per cent in 10 years. In Vancouver East the benchmark price was $524,700 up 20.5 per cent in one year, up 68.7 per cent in 5 years and up 91.7 per cent in 10 years. In Vancouver West, the benchmark price was $783,700 up 11.7 per cent in one year, up 64.2 per cent in 5 years and up 79.6 per cent in 10 years.

Metro Vancouver is the fifth most popular city in the world among wealthy Chinese investors

Douglas Todd of the Vancouver Sun reports regularly on the impact of offshore money on the real estate market in Vancouver. He writes that many immigration lawyers who travel to Mainland China state that the real cause of the flow of money into the Vancouver real estate market is the 10 year Visa instituted by the Government of Canada in 2014. It has allowed visits up to 6 months without any responsibility to pay taxes here and many parents are investing in real estate using their foreign student children as proxies. The 10 year Visas encourage money laundering and tax avoidance and have fuelled the booming Vancouver and Toronto real estate markets according to Immigration lawyer George Lee.

Todd states that Canada is the second most desired country for multi-millionaire Mainland Chinese according to the Hurun Report and Metro Vancouver is the fifth most popular city in the world for wealthy Chinese investors.

The new NDP/Green government has real estate in its sights. Their programs to create affordability have the support of the larger community of voters. They are looking to close the tax loopholes of "bare trusts" that obscure legal ownership and help avoid all taxes due and payable on a purchase of a property. They are looking to add the foreign buyer tax and all other taxes to pre-sales at the time of purchase. This would prevent buyers from selling their contract on for profit with no tax payable. Specific legislation should come down in the September mini-budget.

With the popular demand for accountability in the real estate industry and a left leaning government who ran on that platform, we will be following the outcome of the change in strategy closely. More anon.

SK00KV