It was once common to use the expression "as the world turns" to explain inexplicable actions. Today the wording has segued into "as the world spins"...off it’s axis. In some ways the old misogynist spirit is abroad in the land as either populist or progressive political theories move forward. It will be interesting to see how Chancellor Angela Merkel fares in the upcoming German elections. The stars of far right French politician and National Front President Marine Le Pen, UK Prime Minister Theresa May and BC Premier Christy Clark have fallen in the month of May and early June.

Political uncertainty is never good for business and the alliance of NDP and Greens following the BC election on May 9 plans to follow an agenda antithetical to resource development. The province divided between urban and rural voters who have totally different views of the economy. Urban voters want free or subsidized everything in order to compensate for the high prices of housing and commodities in the expensive Lower Mainland while voters in the north of the province are worried about their resource or energy industry jobs being lost to the urban agenda that put the NDP/Green coalition in a position of potential power.

It’s difficult to judge the impact of campaign rhetoric on real estate going forward. The real estate market has recovered its mojo on prices. Detached housing which was the big mover in 2016 has fallen off except in price while condos and townhomes have risen in sales numbers and price. Lack of inventory is what is holding back the market although home buyer activity overall returned to near record levels in May. If there is a big rise in the Foreign Buyer Tax which has been touted as going from 15 to 30% we may see a change in these numbers. The imposition of a projected 2% speculation tax will impact investor buyers, especially if added to a 30% Foreign Buyer Tax, all of which has been proposed by Andrew Weaver, leader of the Green Party.

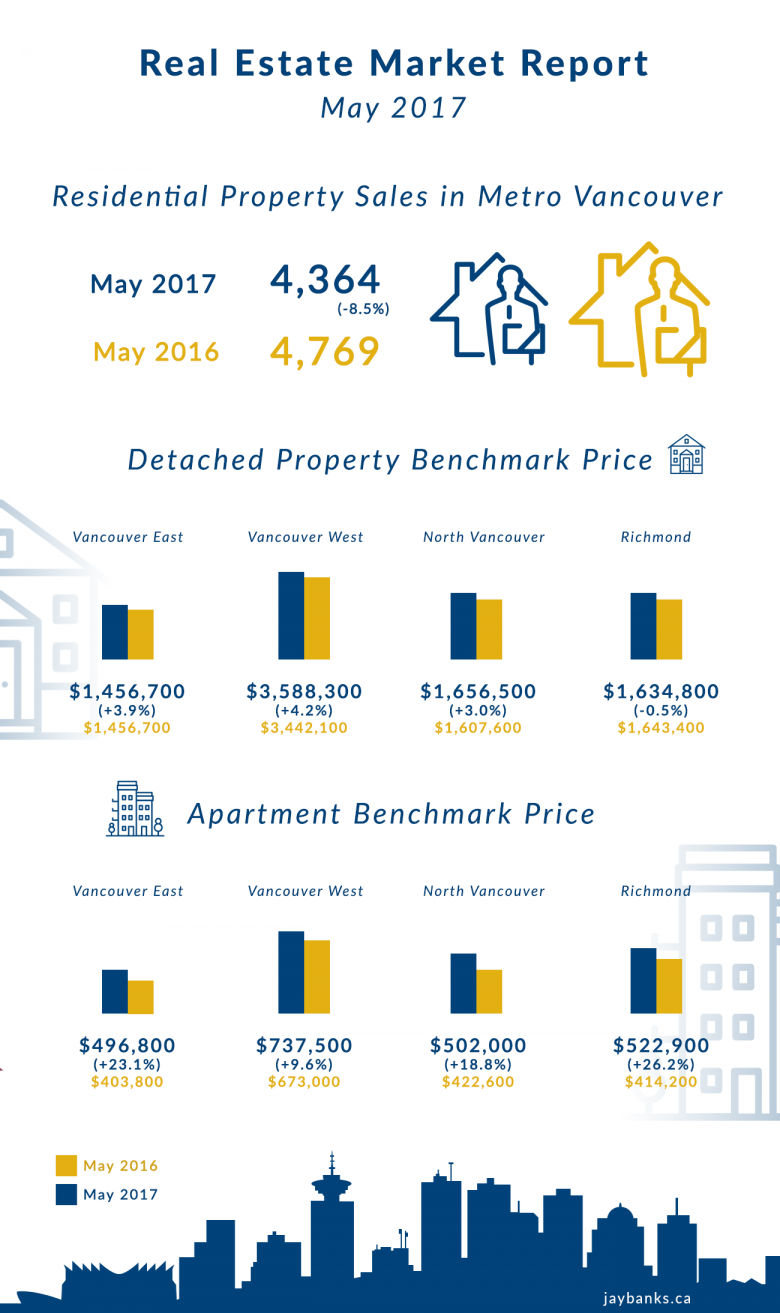

Last month’s sales were 23.7% above the 10-year May sales average and is the third-highest selling May on record.

Benchmark price for Detached homes on the Westside was $3,588,300, an increase of 4.2% from May 2016 before the Foreign Buyer Tax was announced; in Vancouver East it was $1,513,800 which is a 3.9% increase over May 2016; in North Vancouver it was $1,656,500 which is a 3.0% increase over May 2016. In Richmond the benchmark was $1,634,800 a drop of -0.5% from May 2016 and in West Vancouver it was $3,080,600 a dip of -1.5% from May 2016. In Richmond many buyers are required to pay the Foreign Buyer Tax. Foreign buyers for Vancouver Westside where the tax seems to have had surprisingly little impact appear to have very deep pockets indeed.

Townhomes as an alternative to a detached home are much more affordable and highly sought after. Some areas have built more inventory over the past years than have other places but all are popular. The Benchmark price for Townhomes in Vancouver Westside was $1,154,200 an increase of 11.5% over May 2016; in Vancouver East it was $792,300 an increase of 9.2% over May 2016;in North Vancouver it was $917,500 an increase of 14.9% over May 2016; in Richmond it was $762,800 an increase of 11.3% over May 2016. West Vancouver does not offer a statistically viable number of sold townhomes.

As a matter of interest given that the rise in sales has been led by the condominium apartment market the May 2017 Benchmark price for condos follows: in Vancouver Westside the benchmark is $737,500 an increase of 9.6% above May 2016; in Vancouver East it’s $496,800 an increase of 23.1% over May 2016; in North Vancouver it’s $502,000 an increase of 18.8% above May 2016; in Richmond it’s $522,900 an increase of 26.2% over May 2016; in West Vancouver the benchmark was $1,033,000 an increase of 21.3% over May 2016.

As those aspiring to buy homes in Greater Vancouver have come to realize that the impact of world wealth on the prices of detached homes or luxury waterfront condos is not affected by penny-ante Foreign Buyer Taxes the demand for "affordable" housing has moved into the attached home market. These buyers are likely to be affected if the pillars of the economy are knocked down by a new government as has happened in the past as they are local residents dependent on the local job market. This is where the monetary policies of the Bank of Canada and the mortgage requirements of CMHC impact the real estate market. The BoC is concerned that the high levels of household debt and the surging real estate markets in Toronto and Vancouver will impact the entire Canadian economy. So far the economy is resilient but changing governments can make a difference to outcomes.

May 2017 was a wonderful month with a sales to active listing ratio of 53.4% across all residential categories, broken down as Detached 31%; Townhomes 76.1% and Condominiums 94.6%. May the good times continue.

JB00KV