It’s hard to get excited about the end of the Gold Rush Housing Boom in Vancouver when the rest of the world seems to be going up in flames on a daily basis. In fact

"The time has come," the Walrus said,

"To talk of many things:

Of shoes--and ships--and sealing-wax--

Of cabbages--and kings--

And why the sea is boiling hot--

And whether pigs have wings."(Lewis Carroll)

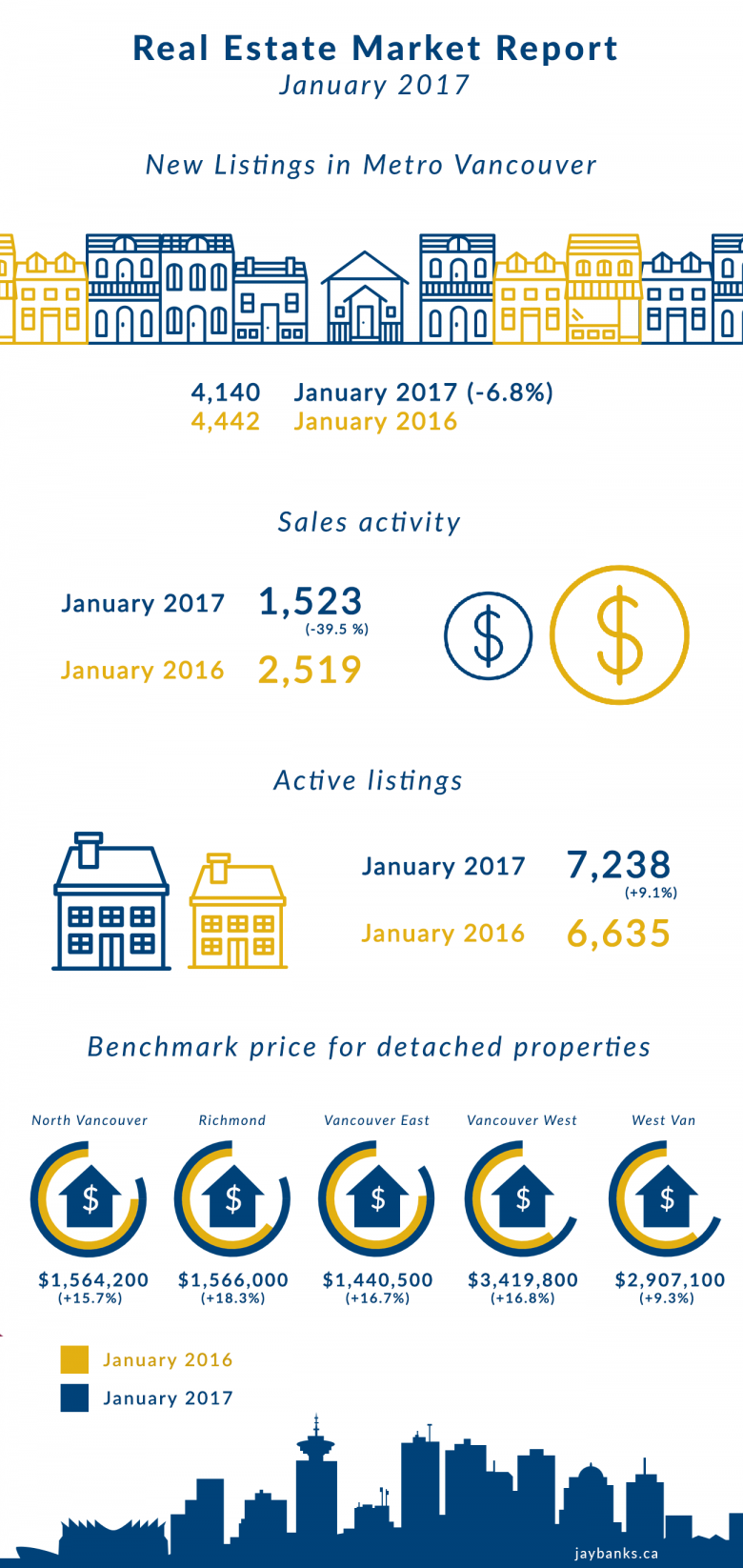

Such topics seem just as relevant as last year’s housing news. The detached market is still out of reach for local buyers and the offshore buyers have vanished. Sales are down about 40% from January 2016. Prices are down about 10-15% but they were up 35% mid-2016 so single family homes continue to be unaffordable. The benchmark price for North Vancouver is $1,564,200; for Richmond $1,566,000; Vancouver East $1,440,500; Vancouver West $3,419,800; West Van $2,907,100. They are all up 16-18% except West Van at 9% in price from January 2016.

The listing inventory is up about 9% over January 2016 but is not fulfilling the demand in the affordable price ranges. There are multiple offers on almost every property under $500,000 but there are serious constraints on bank approval for purchases. Vancouver and suburbs are full of older condo buildings that are now being analyzed for the Depreciation Report required by the BC Government Housing Ministry. These reports are an eye opener to buyers and a red flag to lenders. Now that CMHC mortgage insurance requires more liability to be covered by the bank it has triggered a 20% downpayment policy for many condo buildings. According to the BC Government website: A depreciation report tells a strata corporation what common property and assets it has and what are the projected maintenance, repair and replacement costs over a 30 year time span. Common property is just not buildings. Seeing future costs laid out in black and white is a sobering experience.

The costs of buying and the higher downpayments is depleting the RRSP reservoir as buyers take their tax-free savings to buy homes.

The sales numbers are down mainly due to the fall off in detached sales as there still is demand for certain products. According to Dan Morrison, President of the Real Estate Board of Greater Vancouver, "Conditions within the market vary depending on property type. The townhome and condominium markets are more active than the detached market at the moment. As a result detached home prices declined about 7% since peaking in July while townhome and condominium prices held steady over this period." The sales-to- active listings ratio for January 2017 is 21%; the lowest since January 2015. Prices don’t usually drop seriously until the sales-to-active listings ratio is below 12%.

In Richmond over the Chinese New Year there were surprising sales in nice neighbourhoods of older homes. The $2 million price range was popular. The empty $3 million mansions did not sell. These may have been visiting buyers who got their money out of China before the new currency controls went into effect. Controls have been tried before and have usually been ineffective at preventing enormous amounts of capital fleeing China.

The government has taken a much more interventionist approach this time and Chinese citizens looking to convert their money and send it overseas must go into the bank to do so and sign a waiver stating that they will not use the funds to purchase real estate or securities while travelling. The enforcement is heavy handed and those middle class Chinese buyers who have impacted the housing markets in Vancouver, London, Sydney are now afraid to defy their government and do not have the off-shore funds available to complete new home/condo purchases around the world. The developers who have Chinese pre-sale clients are being left high and dry with half-finished buildings. The mega rich corporate tycoons already have money stashed in banks around the world so are not so affected.

The perceived catalyst for sending buyers from Vancouver to Toronto and elsewhere is the BC Foreign Buyer tax of 15% added to the existing Property Transfer Tax for non-resident buyers who aren’t Canadian citizens or Permanent Residents who buy in the Lower Mainland. Although this was pointed out at the time the tax was enacted the government ignored the problem until closer to the upcoming election and are now back tracking on levying the Foreign Buyer Tax on those buyers coming to Vancouver to work. Many tech people and others recruited here by their employers were sandbagged by the additional tax levied without notice. No legislation yet but Premier Christy Clark has said that they will exempt working foreigners and may refund taxes to those who already paid.

The City of Vancouver has discovered that the population has shrunk in high-priced neighbourhoods and that vacant homes are up 15% since the 2011 census. In both Vancouver and Toronto buyers are flocking to the suburbs where housing is newer and prices more reasonable. Surrey and Langley are having huge growth spurts. A successful realtor in Barrie, Ontario which is 100 km north of Toronto was saying that most of detached home sales there are to Chinese buyers. Not every foreign buyer is ultra-wealthy and if they are planning to move to Canada they are looking for neighbourhoods of well-maintained or newer homes and good schools.

There are warnings coming from economists that in the housing markets that aren’t Vancouver or Toronto home prices fell over this past year. There is worry that the buoyant housing markets that carried Canada through the oil price drop of 2016 may be slowing enough to drag down the national economy. According to David Madani of Capital Economics there is no macroeconomic catalyst or trigger including the Foreign Buyer Tax that caused the sudden slow down in the Vancouver market. He says the market was largely driven by "unpredictable investor mania". Also the lax enforcement of money laundering laws and primary residence requirements by CRA. All coming under much more scrutiny now as many investors head for the hills or Toronto.

SK00SK