The party's over

It's time to call it a day

They've burst your pretty balloon

And taken the moon away

It's time to wind up the masquerade

Just make your mind up the piper must be paid...

— by Betty Comden, Adolph Greene, Jule Styne

Detached home sellers all over Metro Vancouver are paying the piper for escalating prices, loose legal and financial rules and unrestricted offshore investment purchases that resulted in unsustainable growth and today’s hangover from all the excess. Around the world wealthy countries are pulling the welcome mat out from under buyers who distort markets and make them unaffordable for local residents. People in Vancouver have been saying for years that the provincial and federal governments were enabling offshore immigrants and investors to purchase luxury properties and to treat Vancouver like a holiday resort instead of the vibrant active city with a unique culture that it is.

Vancouver by Imogene Huxham

Vancouver by Imogene Huxham

The Foreign Buyer Tax of 15% added to the existing Property Transfer Tax (The PTT is charged on the fair market value of a property at a rate of: 1% on the first $200,000; 2% on the balance up to and including $2,000,000; 3% on the balance greater than $2,000,000) has made buyers more wary of purchasing in Metro Vancouver. Not because they can’t afford it but investors no longer see their way to use the weak enforcement of existing laws to work in their favour. The provincial government has outlawed shadow flipping whereby Contracts of Purchase and Sale for properties can be resold multiple times with a bump at every level until the final purchaser pays the increased price, registers title and pays the statutory taxes. Wholesale money laundering through real estate sales is becoming more difficult. The legal profession that got a pass from the Supreme Court on having to disclose the shady financial affairs of their clients based on the concept of privacy and self-incrimination is now getting a closer look from the Canada Revenue Agency (CRA). The honour system of reporting a sale of a principal residence without triggering capital gains taxes has been exploded by CRA after investigative journalists reported the number of non-residents and builders who were claiming multiple empty homes as their principal residences and therefore paying no tax on the increase in equity between purchase and sale prices. There has been a thirty-five percent bump in prices between 2015 and 2016 alone.

Hong Kong which wins the prize for the most unaffordable real estate in the world and is under siege by Mainland Chinese buyers who want to own multiple properties there has just raised its Stamp Tax (analogous to our Property Transfer Tax). Currently in HK it is 8.5% on all sales over HK$2 million to be raised to 15% flat rate on all properties for non first time buyers. The Stamp Tax is not levied on Permanent Residents buying their first home. Initial reports are that this sudden announcement has slowed the real estate market there.

Vancouver Market in October 2016

Vancouver Market in October 2016

In Canada Toronto is currently the darling for offshore buyers investing in Canada. There is a huge condo building boom that has attracted massive investment. Single family house prices are closing in on Vancouver prices; there is no inventory in single family homes even a two hour commute from Toronto. The Premier of Ontario has said they won’t enact a Foreign Buyer Tax there but Premier Christy Clark said the same thing until she was forced by political reality to do so in BC. In fact it has severely reduced the Provincial Treasury takings from the real estate Golden Goose.

In Vancouver the culprit for high prices is the lack of available land to build on. Eighty per cent of the city is zoned single family with high rise construction at the centre downtown. The City has subtly increased density by allowing a laneway house and a basement suite in every detached house in Vancouver. The downside is that title to the property remains single family. The other residences on the property cannot be severed or sold. The rezoning of main streets for low-rise multi-family homes has caused speculation in land prices as groups of owners get together to sell as one package. The high land costs mean high development costs which means even multi-family properties are prohibitively expensive. Vancouver is also infamous for the amount of red tape tying up any building applications. Surrey and Burnaby are much more development friendly.

The changes by the Federal Government to the mortgage rules and CMHC guaranteed mortgages for buyers with less than a 20% downpayment has impacted sales across Canada. The purpose of the changes was to lower levels of household debt so the economy would be less vulnerable in a downturn. The Governor of the Bank of Canada has stated that these changes were more useful than adjusting the bank interest rate. The new mortgage stress test requires borrowers to qualify for a mortgage at an average of the posted rates of the 5 big banks. In Metro Vancouver including the suburbs where buyers could afford to buy a home based on a mortgage at the discounted rate those buyers are now left hanging because they don’t quite qualify for the same amount of mortgage at the higher rate. Formerly the buyer may have been offered a mortgage at 2.2% and after October 17 had to qualify at 4.65%. According to many realtors there are unhappy clients out there whose future plans have been derailed. Purchases have had to be tailored to the new mortgage requirements and some buyers have had to drop their approved price range from $650k to $450k.

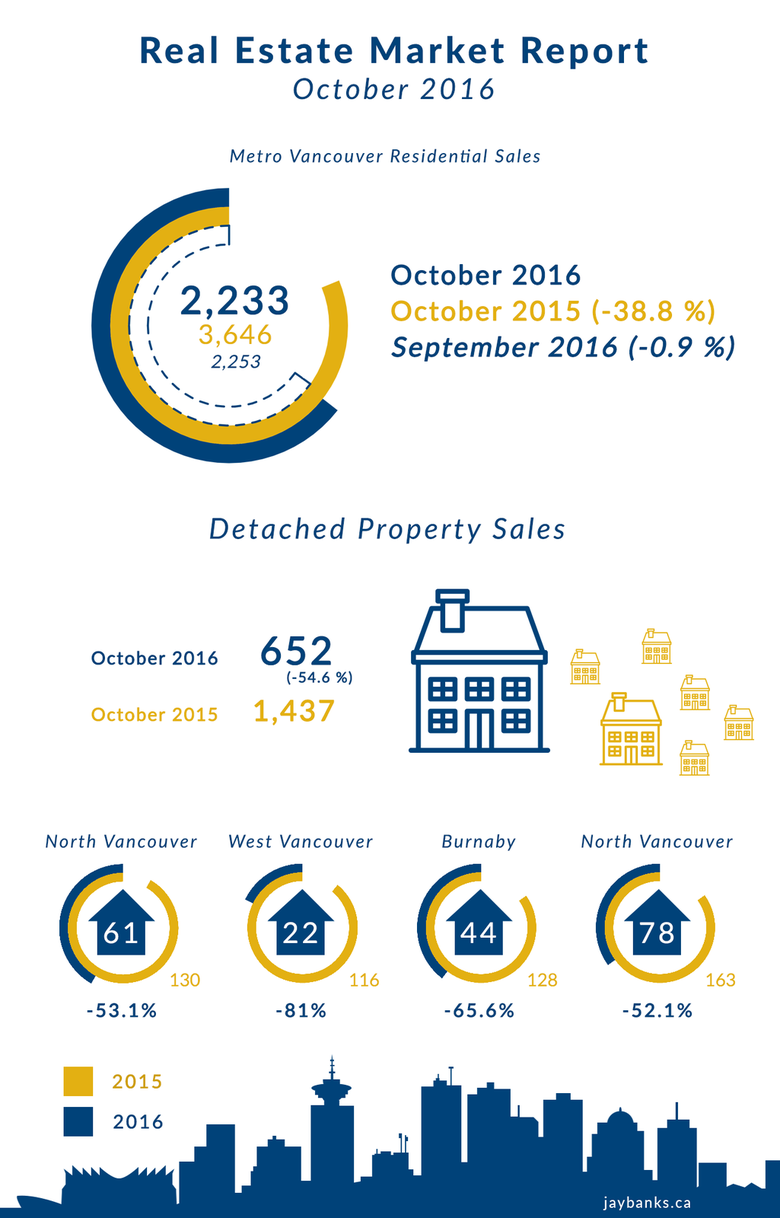

There seems to be a wait and see attitude of both sellers and buyers to the changing market conditions. Prices haven’t dropped as much as the number of sales has tapered off. Buyers are hoping that prices do come down to make homes more affordable. There was a big drop in October but it appears that buyers are starting to make decisions again. There is a strong push toward townhomes with many new projects being built in Surrey, Langley and White Rock. The single family home closer in is still unaffordable for most buyers. There was a 55% drop in sales of detached homes in Metro Vancouver when comparing the months of October 2015 and 2016. The benchmark price in October 2016 is $1,545,800 which is a 28.9% increase from October 2015. In Metro Vancouver’s two highest priced residential districts Vancouver Westside and West Vancouver the benchmark price is $3,570,000 and $3,200,000 respectively.

There is a noticeable difference in the number of detached sales: in Vancouver Westside in October 2015 there were 163 sales vs 78 sales in October 2016. In Richmond there were 194 sales vs 61 sales. In North Vancouver there were 130 sales vs 61 sales.

We shall have to wait to see how the arc of history bends next month.

JB00DT