We are on a wild roller coaster ride in the Vancouver real estate market. Right now we are inching up the incline where we are almost at the top...will we plunge down through all the bad economic and world news to soar up the other side to new heights or will the Chinese government derail the roller coaster by disallowing their citizens from sending personal savings out of the country to fuel the Vancouver real estate market?

A Vancouver Winter by Ruth Hartnup

A Vancouver Winter by Ruth Hartnup

The general consensus is that real estate in Vancouver will only get more expensive as the worldwide demand increases and the supply diminishes. As a prominent Toronto developer pointed out Vancouver is a natural island with limited development opportunities while Toronto proper is manmade through the imposition of green belts and parkland around the metro area.

There is much handwringing about the falling Loonie but in fact it has been a boon for foreign investment in the real estate market...buyers are getting a fire sale price with a 30% discount on luxury homes and condos.

The basic scenario has not changed...there are many more buyers than properties available for sale in the detached market which is also spilling over into the other segments as well. Condos have gone up substantially in some areas. Yaletown near the Seawall is popular with all buyers.

Local sellers are nervous about listing their homes because there is nothing available to purchase if they want to move up or downsize. Newer condos with the 5/10 year warranty plan in place are at a premium. New projects close to transit with high walkability scores have lineups to purchase from the plans and prospectus.

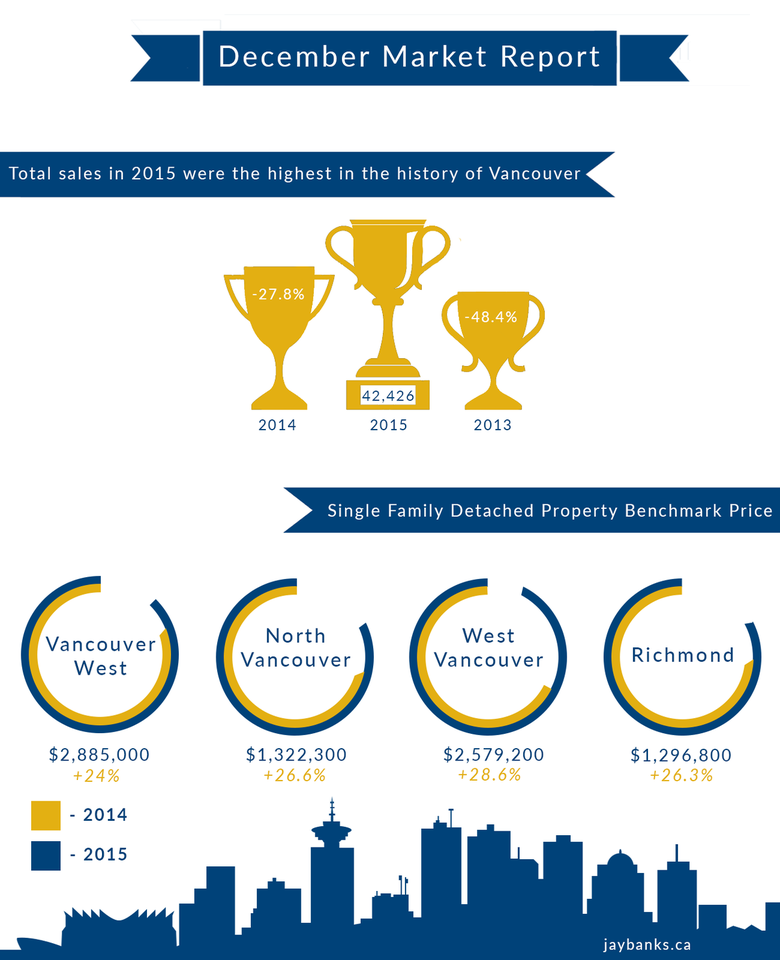

Sales in 2015 were the highest annual total in the history of the Real Estate Board of Greater Vancouver. Sales of detached, attached and apartment properties reached 42,426. This was a 27.8% increase over 33,116 sales in 2014 and a 48.4% increase over the 28,524 residential sales in 2013.

The figures for 2015 would have been higher had there been more properties listed for sale. A prominent Vancouver realtor who markets properties assembled by groups of owners who hope to take advantage of potential rezoning to maximize their profit in selling their homes to longterm offshore investors has found that good offers are being refused due to lack of inventory and high prices for those sellers who want to purchase another home.

There is lots of public angst about the lack of affordability and the subsequent emptying of the city of young families and older citizens who can’t afford to buy or even to rent at today’s price point. The benchmark detached home price across Greater Vancouver is $1,250,000. Fifty-three neighbourhoods have a base price of a million dollars for a detached home according to the BC Assessment Authority. In the premium neighbourhoods of Vancouver Westside and West Vancouver the benchmark is $2,885,000 and $2,580,000 respectively. Those prices reflect older homes that will be torn down. Another civic sore spot is that many of these homes are purchased as investments and left standing empty to spoil a formerly charming neighbourhood. Richmond residents are opposing the zoning that allows mega homes to be built that overshadow their neighbours and cut off sunlight and privacy.

According to realtors who work the Mainland Chinese market the new buyers are not the ultra wealthy of earlier days. Those trying to get their money out and into real estate investments in the West are the upper middle class who have savings that they don’t want to lose in the Shanghai stock market or have confiscated by the government. For Chinese parents planning to emigrate the impetus is their children’s education. The schools and colleges in China are not up to western standards except for the elite institutions. Because the drive is to enroll the children in English speaking schools the countries of choice are Canada, the US, Australia and the UK.

As reported here last month there is a huge groundswell of families from China moving across the US to towns with good schools and public universities. Except in the desirable East Coast and West Coast major cities most real estate in the US is extremely affordable by Canadian standards plus mortgage interest payments are tax deductible. According to the New York Times some families are purchasing multiple homes so that they are in the catchment areas for good schools at the elementary and secondary levels.

Vancouver is still the most expensive worldwide city to buy in but BC and Canada are known for their lax money laundering rules , lack of taxation enforcement and opacity regarding the source of home ownership so the extensive immigration scam in Richmond reported on last month was easy to perpetrate. It appears in all these phony immigration consultant scams regarding fulfilling residence requirements for citizenship that the potential immigrants were complicit in making false statements and disregarding Canadian rules. Flouting income tax laws for tax refunds was just icing on the cake.

When a critical mass of the public demands information the government in question will have to deliver it, especially in BC where there is an election next year. The BC government is loath to undermine the billion dollars per year the treasury is receiving from the Property Transfer Tax on all real estate sales. BC is the only province in Canada with a balanced budget but it still needs the PTT windfall to pay down the debt. As per the above mentioned election in 2017 the premier is now talking about lowering the PTT in some categories.

The downside to all the calls for speculation taxes, strict rules for foreign ownership is the Law of Unintended Consequences. There is a large portion of the population who purchased homes many years ago and are counting on their increased equity to finance their retirements. They would not be happy to see their homes devalued.

There will be more to report after the Lunar New Year festivities in Vancouver starting February 8. This is the time that a billion people in China travel home to see their families. Many of them now have families in Canada so the Chinese New Year celebrations are a huge economic and cultural event here too.

JB00DT