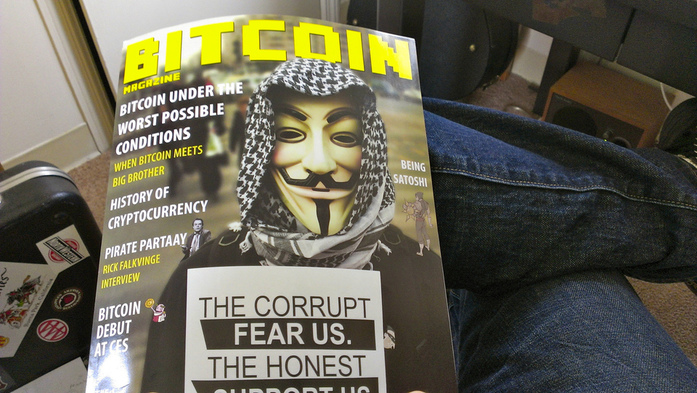

Bitcoin Magazine by Zach Copley

Bitcoin Magazine by Zach Copley

Many people are asking the same question: what is all the fuss over Bitcoin? Well, there’s no simple answer, even though bitcoins have certainly made it to the stage of the global media. While Bitcoin supporters still confidently claim that "Bitcoins are the future of the web," the rest of us are far less enthusiastic about the best-known virtual currency after its (let’s try to be as precise as possible) volatile period in 2013, when the Bitcoin value crashed from $266 to $105 and returned to $160 within several hours on April 10. Value at the end of June 2013 was approximately $92, which doesn’t seem to offer much consolation. But let’s start from the very beginning and explain what Bitcoin actually is.

What is Bitcoin?

Bitcoin was invented in 2009 by a mysterious developer nicknamed as Satoshi Nakamoto as a decentralized virtual currency, which means it's not controlled by a person or institution such as a central bank. It doesn’t exist in the physical world, so you won’t find an actual Bitcoin banknote, and if so, it's certainly fake. (But visitors of the first Bitcoin London Conference in London in July 2013 had a chance to use a special ATM that chews up your banknotes and gives you a computer code in return.) The ultimate goal is to issue a finite number of bitcoins set at 21 million approximately by 2014 and therefore eliminate any possible speculation about manipulating the value of the currency by emitting more bitcoins, just like central banks do with real-life currencies. At the moment, there are about 11.3 million bitcoins in circulation.

Tech-savvy libertarians and anarchists alike have cheered Bitcoin as the first payment option with no strings attached — no government control and no extra transfer fees involved. Indeed, bitcoins bring much greater privacy than ever imagined, as they carry no serial number and there's virtually no way to trace them back to the buyers or sellers. However, what pleases one part of the Internet community and privacy advocates raises concerns among others. Many have expressed worries about criminals using bitcoins to cover for illegal activities such as drug dealing or even funds supporting terrorist cells, which led some governments to apply money-laundering regulations to the currency.

How to obtain bitcoins

Firstly, you can buy and exchange bitcoins just like any other currency. You can use the Japan-based Mt. Gox company, which exchanges bitcoins for 17 world currencies, and similar marketplaces established in Germany, France, and even Russia. However, if you feel like creating your own bitcoins, there's a way to mine them with your computer by completing a complex mathematical problem and deciphering a 64-digit number. The more powerful your computer is, the faster the acquisition of the block of 25 bitcoins goes. There's also a set limit of a maximum 25 new bitcoins per ten minutes in order to prevent inflation. Especially because of the mining process, it's more useful to imagine Bitcoin as a commodity rather than a traditional currency.

How and where to use bitcoins

Even though Bitcoin is used by an insignificant proportion of the world’s population, it’s gaining recognition — especially in the Western world, including North America and Europe. Some Internet companies, including WordPress, the social news site Reddit, and online dating site OkCupid are slowly starting to accept bitcoins for their services. However, at the moment, bitcoins are generally more useful as a means of exchange than an actual means of payment.

The April drop's aftermath

Bitcoin enthusiasts still hope to see the virtual currency go global, but there are several challenges it must overcome first. Bitcoin is probably the first relatively widespread currency that's not part of the world’s financial system, which has both its pros and cons.

As outlined in the beginning of the article, the currency struggles with unpredictable volatility, and not even the greatest names in the economics world dare to predict its future. No respectable commodity — not even currency — can afford such rapid price fluctuations as the kind Bitcoin witnessed in April, with a plummet from $260 to $130 within a day. Experts claim that investing as little as $3 or $4 million into the main trading platform Mt. Gox can cause a jump in prices.

This volatility is easy prey for price speculators, who attempt to make money out of the price changes. Brian Riley, a senior research analyst at the Virginia-based research and advisory firm CEB TowerGroup, puts it more bluntly for the BBC: "Bitcoin’s main problem is that value is based on whatever the next guy will pay. This makes them a speculative currency."

At the moment, there are two types of Bitcoin users, who respond differently to the instability. Some owners simply use the currency as a medium value and spend it immediately after acquisition in order to keep the value relatively fixed. Others believe that the Bitcoin project can be successful and keep the currency as an investment, and that they don’t necessarily react to temporary fluctuations that remain unpredictable, like the future of Bitcoin. Because of this, it's not advisable for investors to keep more than 5 per cent of their portfolio in bitcoins. And for many conservative-oriented businesspeople, 5 per cent would still be considered a reckless investment.

On the other hand, nobody can deny that if any commodity’s value manages to climb 50 per cent within a year, it naturally attracts attention. The hype around Bitcoin was recently fuelled by Tyler and Cameron Winklevoss, high-profile twin investors who became famous after their legal dispute with Mark Zuckerberg over Facebook. The Winklevoss twins announced their intention to offer shares of a so-called Bitcoin trust — an exchange-traded fund for the public.

Digital Currency Beats the Paper? Photo by Zach Copley

What comes next?

It’s very difficult to write down anything credible about possible future developments of Bitcoin. Some expect Bitcoin to become a sweeping global phenomenon, but even more people point out that bitcoins will probably end up as a pioneer of an extensive digital money exchange system in the coming years. There are already too many examples of innovative technologies that simply couldn’t compete with their more sophisticated spin-offs — just look at the MySpace story. Jenifer Kramer, a social marketing expert, also takes our attention to the fact that there are plenty of concepts that remind us of Bitcoin's idea, such as Amazon Coins and Facebook Credits, that we're already used to without much second thought. Several start-ups also introduced Bitcoin’s direct virtual currency competitors, including Litecoin and Ripple. Even though they don’t seem particularly threatening at the moment, we've learned that technologies and the hype around them unfold faster than ever in the interconnected virtual world.

It really seems that nobody's able to predict Bitcoin’s future, but one thing's for sure: exciting things are happening, so stay tuned and let’s follow the Bitcoin story together.